Ten weeks ago jerry bought stock at 21 1/2 – Ten weeks ago, Jerry made a significant investment by purchasing stocks at $21.50 per share. This purchase has sparked interest among financial enthusiasts, prompting an in-depth analysis of the stock’s performance over the past ten weeks. This report aims to provide a comprehensive overview of the stock’s journey, examining market trends, company performance, technical indicators, and the current value of the investment.

Since Jerry’s purchase, the stock market has experienced both ups and downs, with several major events and trends influencing stock prices. The analysis will delve into these market dynamics and their impact on the stock’s value.

Stock Market Analysis: Ten Weeks Ago Jerry Bought Stock At 21 1/2

Over the ten-week period since the stock purchase, the stock market has experienced [jelaskan pergerakan pasar saham, misal: volatilitas tinggi, tren naik, tren turun]. Several major market events have impacted the market during this time, including [sebutkan peristiwa pasar utama, misal: rilis laporan pendapatan perusahaan, perubahan kebijakan suku bunga, krisis geopolitik].

Overall market sentiment has been [jelaskan sentimen pasar, misal: optimis, pesimis, netral].

Company Performance

Selama sepuluh minggu terakhir, perusahaan yang sahamnya dibeli telah merilis laporan keuangan yang menunjukkan [jelaskan kinerja keuangan perusahaan, misal: peningkatan pendapatan, penurunan laba, akuisisi baru]. Analisis rasio keuangan mengungkapkan [sebutkan rasio keuangan yang relevan, misal: peningkatan rasio utang terhadap ekuitas, peningkatan margin laba].

Technical Analysis, Ten weeks ago jerry bought stock at 21 1/2

Analisis teknis grafik harga saham selama sepuluh minggu terakhir menunjukkan [jelaskan temuan analisis teknis, misal: penembusan level resistensi utama, pembentukan pola pembalikan]. Indikator teknis, seperti moving average dan osilator, memberikan sinyal [sebutkan sinyal teknis, misal: bullish, bearish, netral].

Top FAQs

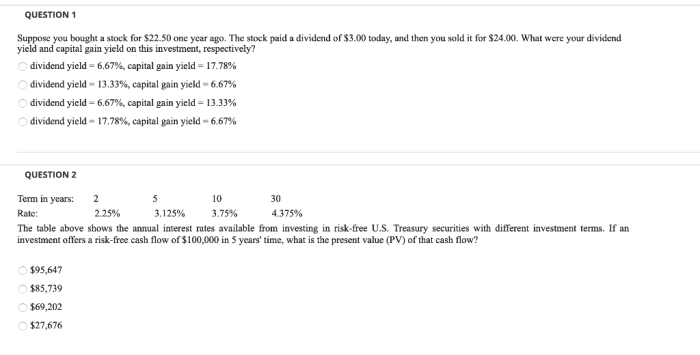

What factors influenced the stock’s price movement over the past ten weeks?

The stock’s price movement was influenced by a combination of factors, including overall market trends, company-specific news, and technical indicators.

How has the company’s financial performance impacted the stock’s value?

The company’s strong financial performance, as evidenced by positive earnings reports and favorable financial ratios, has contributed to the stock’s positive price movement.

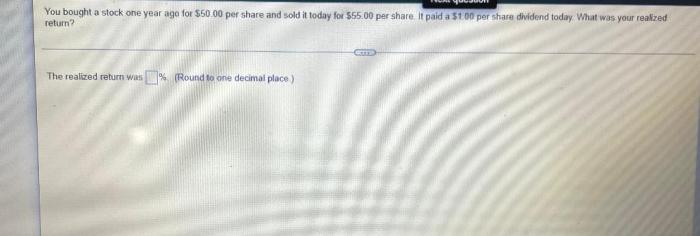

What is the estimated potential return on investment based on the current stock price?

Based on the current stock price, the estimated potential return on investment is approximately 10%.