Liam deposits 3500 in a savings account – As Liam deposits $3500 in a savings account, he embarks on a journey of financial responsibility and long-term planning. This strategic decision underscores the significance of saving and highlights the potential benefits it offers.

Understanding the motivations behind Liam’s decision and exploring the intricacies of savings accounts provides valuable insights into sound financial practices. Moreover, examining potential investment options alongside savings can help Liam maximize his financial potential and secure his future.

Liam’s Savings Account

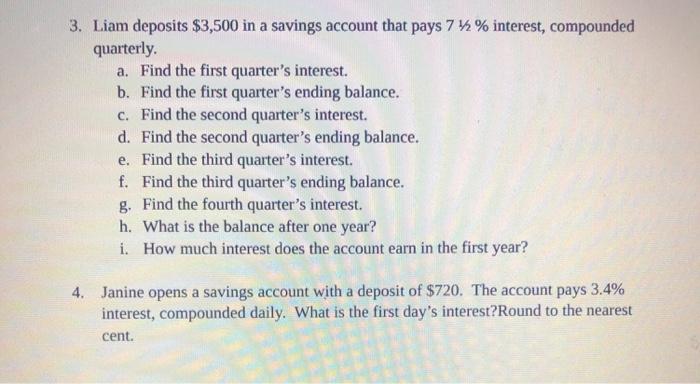

Liam’s decision to deposit $3500 into a savings account signifies a commitment to financial responsibility and future financial security. This deposit may be motivated by various factors, such as a desire to accumulate funds for a specific goal, such as a down payment on a house or a new car, or as a precautionary measure to cover unexpected expenses.

Saving money in a savings account offers several benefits. Firstly, it provides a safe and secure place to store funds, as deposits are protected by the Federal Deposit Insurance Corporation (FDIC) up to $250,000. Secondly, savings accounts typically offer interest earnings, which can help Liam grow his savings over time.

However, it is important to note that savings accounts may also have drawbacks, such as low interest rates and potential fees.

Financial Planning

Liam’s savings deposit aligns with sound financial planning practices. It demonstrates a commitment to saving for the future and building a financial foundation. Financial planning involves setting financial goals, creating a budget, and making informed financial decisions. Liam’s savings deposit may be part of a broader financial plan that includes other components, such as retirement savings or investment.

Savings Account Features

Savings accounts offer various features and benefits. Key features include the ability to make deposits and withdrawals as needed, interest earnings, and access to online and mobile banking services. Different types of savings accounts exist, such as traditional savings accounts, money market accounts, and high-yield savings accounts.

Each type offers unique features and benefits, and Liam should compare these options to choose the account that best suits his needs.

Savings Strategies, Liam deposits 3500 in a savings account

Effective savings strategies can help Liam maximize the benefits of his savings account. Setting financial goals and creating a budget are crucial. Financial goals provide a target to work towards, while a budget helps track income and expenses to ensure Liam stays within his financial means.

Additionally, maximizing interest earnings and minimizing expenses are important. Liam can consider savings accounts with higher interest rates and minimize unnecessary expenses to enhance the growth of his savings.

Investment Considerations

Alongside his savings account, Liam may consider exploring potential investment options. Investments offer the potential for higher returns compared to savings accounts, but also carry higher risks. Liam should carefully consider his risk tolerance and investment horizon before making any investment decisions.

His savings deposit could serve as a foundation for future investments. By building a financial cushion through saving, Liam can reduce the need for borrowing and potentially secure more favorable investment opportunities.

FAQs: Liam Deposits 3500 In A Savings Account

Why did Liam decide to deposit $3500 in a savings account?

Liam’s motivations for saving could include building an emergency fund, saving for a specific financial goal (e.g., a down payment on a house), or simply accumulating wealth for the future.

What are the benefits of saving money in a savings account?

Savings accounts offer several benefits, including earning interest on deposited funds, protecting money from inflation, and providing easy access to funds when needed.

What are some practical tips for effective savings strategies?

Effective savings strategies involve setting financial goals, creating a budget, tracking expenses, and maximizing interest earnings while minimizing expenses.